Are you sweating over price of your job, tolls, petrol, food, car/ business/ study/ housing loans, electricity, transport, medical bills etc etc etc, yet?

Have you lost your money in the KLSE or any mega-loan scam lately?

Are you cursing Madoff & his Ponzi Scheme for the Global Fonancial Meltdown? No?

Or Maybe you'd like to Curse AIG, GM, Bankers, the Feds and a "Jewish conspiracy against Muslim failed states", then ....... No again?

Okay then- maybe you can train some guns closer to home then - no further.

We apparently have ValueCap's policy of non-disclosure (as reported by Asia Sentinel), and mysteriously "endearing qualities" to the Finance Ministry helmed by non other than Najib, the future Umno President & PM of Malaysia!

One might wonder what would happen to Najib's recently revealed RM60billion package, which was meant to stimulate Malaysians to heights of economic orgasms. Don't worry about where it will all come from -he's got the goods, and it's the pedigree "Najib's package", remember?!

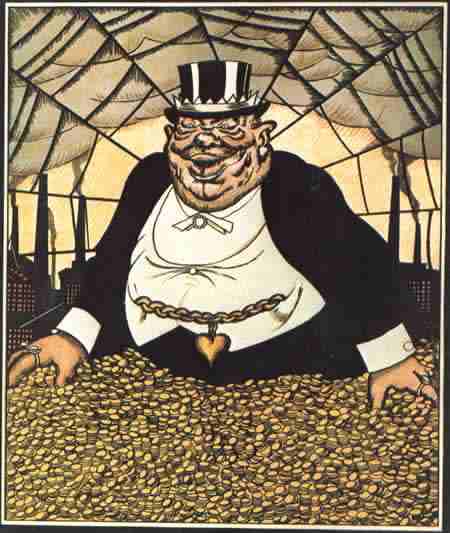

Keeping the OSA protected Petronas accounts, Carrian Holdings/ Bank Bumiputra, Perwaja, PKFZ, OPV, Bakun Dam, Gamuda, IPP, Toll Concessionaires, Irag Oil for Food Program and what not in mind, read the following which was published in Malaysia Today .... and just ask where just RM5 billion of your poor man's hard-earned EPF & taxes went!

Have a blast on "Najib's package", guys ....

Are Kuala Lumpur's rent-seekers raiding the public purse again?

Are Kuala Lumpur's rent-seekers raiding the public purse again?

The Valuecap controversy has thrown the government onto the defensive at a time when it is under attack on a number of fronts, particularly over the independence of the judiciary and the prevalence of so-called "money politics," a Malaysian euphemism for political corruption.

THE CORRIDORS OF POWER

Eric Ellis, Asia Sentinel

It is Malaysia Inc's mystery company, a state-owned investment house few seem to want to talk about, much less know about. Rare is the Malaysian who has ever heard of it, knows who comprises its board, the background of its senior management or, indeed, knows much of what it actually does. It doesn't have a website, and telephone calls to its notional head office go unanswered.

Having any sort of meaningful contact with its elusive executives is near as painful as pulling teeth, as calls, emails and questions go begging, unreturned and unanswered.

When one does actually make contact with the company, which sits at the intersection of Malaysia's top-level business and politics, its response is one of hostility, to threaten legal action. Even though it is owned by a Malaysian public anxious to know how its money is being handled, its message seems patently clear; stay well away.

Welcome to the secretive world of ValueCap Sdn Bhd, which was forced in late February to extend the maturity date of its US$2.7 billion in bonds for another three years. ValueCap was conceived in 2002 as a Malaysian version of Hong Kong's Tracker Fund, a powerful device to support the stock market. Three Malaysian government enterprises are behind Valuecap; the main state holding company Khazanah, the state pension trust fund KWSP (EPF), and the government's fund management arm, Permodalan Nasional Bhd (PNB).

But with funds equal to only around 1 percent of the Malaysian stock market capitalisation compared with the HK fund's $30 billion war chest, ValueCap seems a poor relation to its northern cousin at the very least, and particularly underfunded at such a tremulous time in the world economy.

But after operating under the radar for most of its six-year history, in recent months ValueCap has had an unwelcome spotlight trained on it by Malaysians wanting to know more about what their government does. Unused to public scrutiny, the company late last year was debated and attacked in a parliament suddenly full of new opposition faces after last March's elections which, though won by the long ruling Barisan Nasional ruling coalition, saw the government's invincibility disappear when it lost more than a third of the seats. Now every aspect of government is under scrutiny, and the bureaucrats don't seem to like it very much. Indeed, it is becoming a particular problem for Prime Minister-designate Najib Tun Razak, who last November took over the finance ministry, the portfolio ultimately responsible for ValueCap.

The gathering controversy at Valuecap stems from recent revelations that it was supposed to make good a RM5.1 billion bond repayment to its original shareholders by February, returning the money that was seemingly the capital that Valuecap began life with in 2003. Where that gets messy is that the government acknowledged in October that ValueCap would receive a RM5 billion ‘loan' from Malaysia's Employee Provident Fund, which has RM330 billion under management. The government insists the EPF loan is unrelated to the delayed ValueCap bond repayment, and assures that ValueCap is viable. After a spirited November debate in Malaysia's parliament, deputy finance minister Nor Mohamed Yakcop pledged that the RM5 billion EFP loan would not be used to pay off ValueCap's loans.

As scant information dribbles out about Valuecap, rousing suspicions of a bailout - strenuously denied by the government – Malaysians now want to know more about what's going on inside this mystery outfit.

But their problem is the government and its state investment agencies seem intent on not saying much at all. ValueCap resolutely refused to make available details of its portfolio, how it is managed, who advises it or even the resume of its chief executive officer, Sharifatu Laila Syed Ali. Nor will either of its 33 percent shareholders – Khazanah, KWSP and PNB - disclose any details about their status in the ValueCap fund or what, if any, returns they have received from their six year investment.

Inquiries to all four institutions directly responsible for ValueCap hit a circular brick wall. Khazanah spokesman Mohamed Asuki bib Abas said "Valuecap has their own management team and Khazanah as a shareholder could not respond to you on their behalf." Over at PNB, spokesperson Rosli Ismail said that "with regards to the subject matter, we regret to inform that we decline to comment. C'est la vie." It was the same at KWSP. "Unfortunately we are not in position to comment on Valuecap," said its spokeperson.

At ValueCap itself, the response was curiously hostile. "We have strict instructions against disclosing pertinent information of the company," company secretary Husna Hafiza Mohammed said. "We would not hesitate to take any legal action against you ...for any misrepresentations made."

So why all the secrecy? After all, it was Asia's crippling 1990's financial crisis that now prompts Malaysia Inc into claiming that it is going out of its way to be a paragon of transparency and corporate governance, operating under so-called ‘world's best practices.' Indeed, in a 2005 interview with Euromoney, Khazanah's managing director Azman Mokhtar boasted of a new era in transparency and openness at Malaysia's big sovereign wealth fund.

No comments:

Post a Comment

NOTE: We do not live in a Legal vacuum.

A pseudonym/ nickname with comments would be much appreciated.